philadelphia wage tax return

Download forms and instructions to use when filing City tax returns. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

Straccione Discusses Philadelphia City Wage Tax Refunds With Fox29 Wouch Maloney Cpas Business Advisors

These forms help taxpayers file 2021 Wage Tax.

. Your first filing due. The tax applies to payments that a person receives from an employer in return for work or services. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

The City Wage Tax is a tax on salaries wages commissions and other compensation. In addition non-residents who work in Philadelphia are required to pay the. You need to know.

Do I have to file a Philadelphia Wage Tax return. Go to Philadelphia School Income Tax Return. Previously Wage Tax filers submitted a.

These are the main income taxes. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1 2021 the rate for.

Upload Employer Submitted Wage Tax Refund. 2021 City of Philadelphia BUSINESS INCOME RECEIPTS TAX FOR BUSINESS CONDUCTED 100 IN PHILADELPHIA Taxpayer E-mail Address PHTIN EIN SSN 2021 BIRT-EZ DUE DATE. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate.

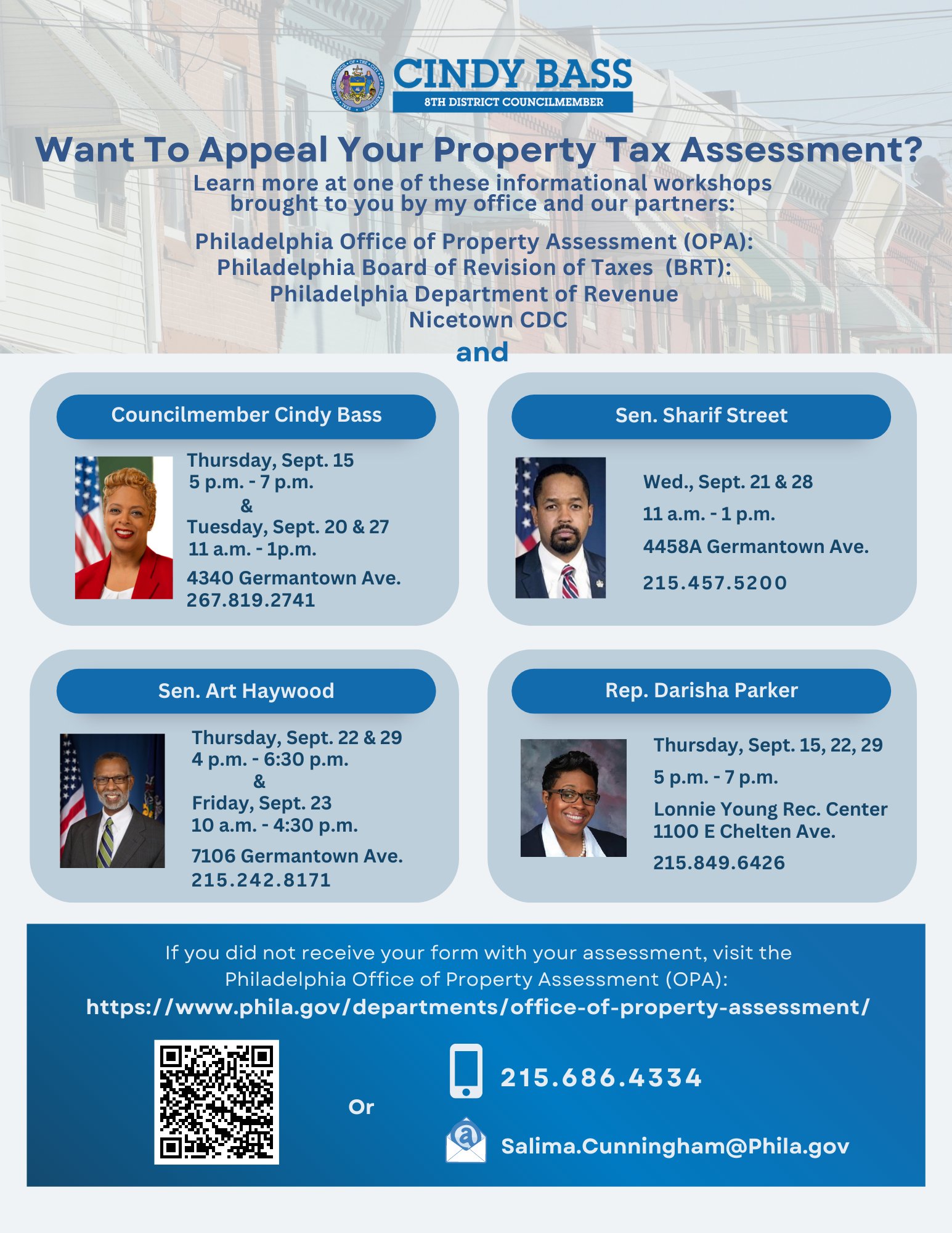

Philadelphia Wage Tax Refund Employer Certification. Philadelphia City Wage tax refunds are available for nonresidents of Philadelphia who are required to work outside the City and had Philadelphia City Wage tax withheld from. Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax.

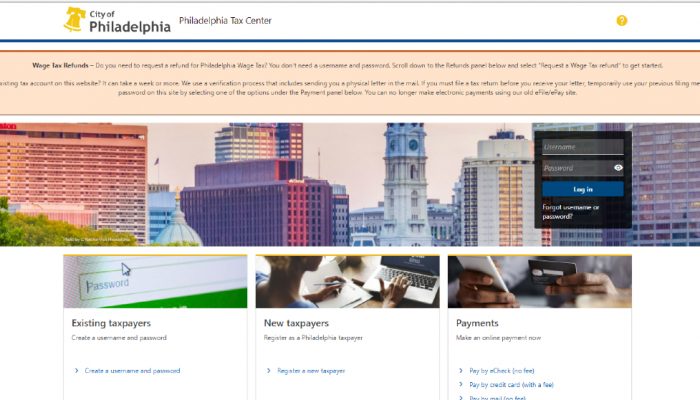

The Earnings Tax and the Wage Tax refer to the same tax and an employer with nexus in Philadelphia will normally withhold and remit the Philadelphia Wage Tax on its employees. Under some curcumstances you may request a refund of wage tax withheld. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

Philadelphia Employee Earnings Tax Return. Business Income and Receipts. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing.

Philadelphia City Income Taxes to Know. 2021 Wage Tax forms. April 1 2022 in Client News Alerts Tax by Adrienne Straccione.

Tax rate for nonresidents who work in Philadelphia. Select Section 1 - General. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

To produce Form NPT or BPT. For residents and 344 for non-residents. Forms include supplementary schedules worksheets going back to 2009.

3 rd quarter filing due date. The Employee Earnings Tax is a tax on salaries wages commissions and other compensation paid to an individual who works or lives in. Non-residents who work in Philadelphia must also pay the Wage Tax.

All Philadelphia residents owe the Wage Tax regardless of where they work. You must now file and pay this tax electronically on the Philadelphia Tax Center. This includes all income-based and Covid-EZ non-residents only.

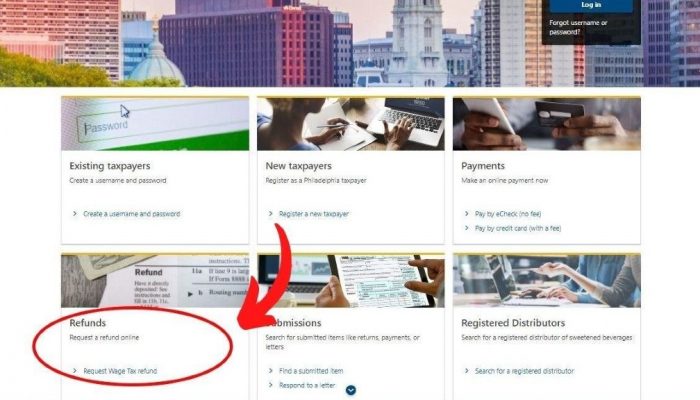

Starting in November 2021 Wage Tax refund requests must be submitted through the Philadelphia Tax Center. In an article published on march 2 2021 in the legal intelligencer shareholder jennifer karpchuk. When no Wage Tax is deducted from an employees paycheck Philadelphia residents are responsible for filing and paying the.

All Philadelphia residents owe the City Wage Tax regardless of where they work. In Line 1 - Prepare Form S-1 checkmark this line.

Philadelphia Revenue Philarevenue Twitter

Philly Eyes Cuts To City Wage Tax Business Tax Rate Whyy

How Working From Home Could Affect Your Tax Bill 6abc Philadelphia

1 29 2002 The W 2 Form For Calendar Year 2001 Almanac Vol 48 No 20

S3 Episode 2 All About Wage Tax Refunds Youtube

How To Get Your Philly Wage Tax Refund Morning Newsletter

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

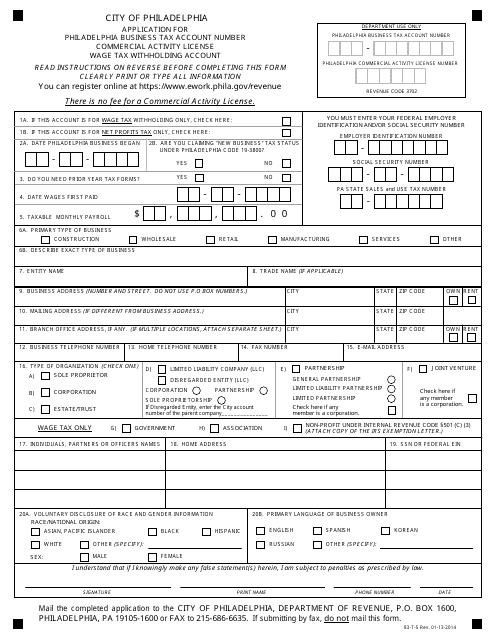

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Do I Have To File A Philadelphia City Tax Return

Success Wage Tax Refund R Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Fillable Online Jefferson Print Form City Of Philadelphia Department Use Only Application For Philadelphia Business Tax Account Number Business Privilege License Wage Tax Withholding Account Philadelphia Business Tax Account Number Philadelphia Business

The Tax Warrior Chronicles Philadelphia Wage Tax

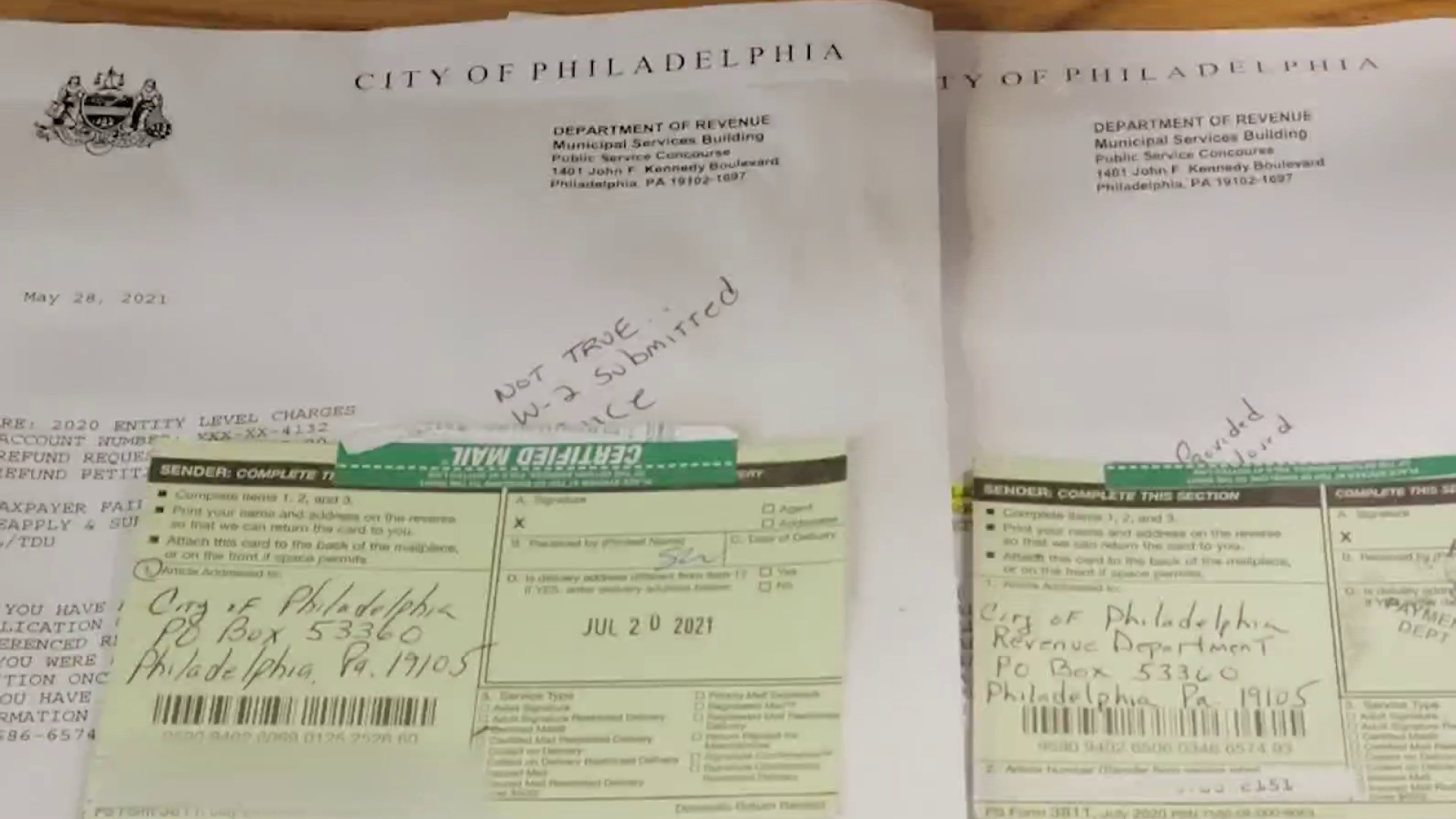

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

How To File For The Philadelphia Wage Tax Refund Nbc10 Philadelphia

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg)

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Philly S City Council Will Take Up The Wage Tax Refund Extension Mayor Kenney Vetoed Pennsylvania Capital Star